Discounts Available For Bulk Purchases

| No. of licences per course |

% saving |

|---|---|

| 1 - 9 | - |

| 10 - 19 | 10% |

| 20 - 49 | 20% |

| 50 - 99 | 25% |

| 100 - 149 | 30% |

| 150 - 999 | 35% |

Anti-Money Laundering Online Course

£20.00 + £4.00 VAT

- Approved by IIRSM

- Certified by CPD

- Audio voiceover

- Approximate course duration 2-3 Hours

- Downloadable certificate on completion

- 100% online training

- No time limits

This Anti-Money Laundering training course explains the UK laws that were implemented to prevent money laundering.

By law, businesses in the regulated sector must put controls in place to prevent financial crime, money laundering and terrorist financing. The regulated sector includes banks, accountants, estate agents, law firms and casinos.

The UK is the second largest money-laundering hotspot in the world. Around £100 billion is laundered through UK organisations every year. This money funds terrorist activities and damages the UK economy, which affects all of us.

With our online anti-money laundering course, you can give yourself or your staff an understanding of how money laundering works and how to prevent it from happening in your company or organisation.

The approximate duration of this online training course is 2 to 3 hours. This is only an estimate based on previous course participants – you can take as long as you like to study the course slides.

Who is Anti-Money Laundering training for?

Anyone will benefit from being educated on money laundering practices. The course is very popular with individuals in job roles that require them to handle and manage cash or finances. This applies whether the organisation is in the regulated sector or outside it.

Reviewed and approved by lead bodies

The training course complies with the Continuing Professional Development (CPD) guidelines and is accredited by the CPD Certification Service.

Our Anti-Money Laundering course has also met the standard of the International Institute of Risk and Safety Management Training Approval Scheme.

Course learning outcomes

At the end of the online Anti-Money Laundering course, you will be able to describe:

- The terms money laundering and terrorist financing

- Global efforts to tackle financial crime

- The money laundering process

- Key laws that address money laundering and terrorist financing

- The role of the regulators

- Who is responsible for compliance in a regulated firm

- Compliance measures that the responsible person must take

- What is meant by a risk-based approach to compliance

- The role of risk assessment

- Customer Due Diligence

- Know Your Customer

- Enhanced Customer Due Diligence

- The essentials of a compliance programme

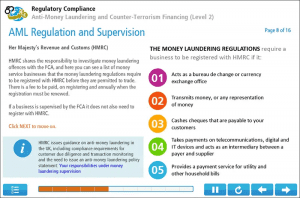

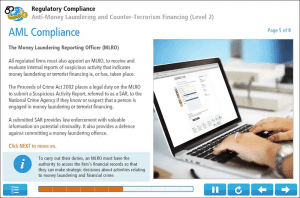

Example course pages

Below are examples of what to expect from our online Anti-Money Laundering training. With years of experience providing training to businesses all over the UK, we’ve learnt how to keep slides straightforward and accessible.

(Click on the example screens below to view)

Course content

The online course contains the following nine topics:

1 – Background

The first topic defines the terms money laundering and terrorist financing. It also explores the consequences and the nature of these crimes. Finally, the topic outlines the role of the Financial Action Task Force.

2 – The Money Laundering Process

In the second topic you will learn about the three stages of money laundering.

3 – Legislation

The third topic outlines relevant UK laws and also describes the offences and penalties under the POCA.

4 – Regulations

Topic 4 identifies the main supervisory authorities in the UK and describes the work they do. It also explains the regulation of high value dealers and outlines the UK sanctions regime.

5 – Compliance

In topic 5 you will learn about the duties of the Money Laundering Compliance Principal and the Money Laundering Reporting Officer. The topic goes on to identify the importance of employee screening and internal audits. The topic also outlines the training and skills needed by employees, the MLCP and the MLRO.

6 – Risk-based Approach

Topic 6 defines the risk-based approach to compliance and outlines the purpose of an AML risk assessment. The topic also provides examples of risk factors in key regulated sectors and explains how to calculate a risk score. You will also learn about when and how to document risk assessments.

7 – Customer Due Diligence

Topic 7 explains the terms Customer Due Diligence and Know Your Customer. Next, it explains what you must do to establish a customer’s identity and how to identify beneficial owners. You will also learn about due diligence checks for regulated and unregulated bodies and the duty to cooperate placed on customers.

8 – Enhanced due diligence

Topic 8 explains enhanced due diligence. Then the topic covers how to verify ID when a customer is not physically present and the concept of the Politically Exposed Person (PEP). Finally the topic describes enhanced due diligence checks for high risk countries and money service businesses.

9 – AML Compliance Programme

The final topic summarises money laundering requirements for UK businesses. The topic also focusses on the role of the MLCP and MLRO and AML risk assessments.

Course assessment

The assessment will contain 20 questions which the course will select from question banks. The questions change each time a candidate takes the assessment, so the course is suitable for initial and refresher training.

You can take as many attempts at the assessment as you need to pass. Knowing this helps participants relax and gain a better score without added pressure.

Course certificate

After completing i2Comply’s online Anti-Money Laundering course, your certificate is available to view, save and print immediately.

Your course certificate will include the IIRSM Approved Training logo and the CPD logo. So you are able to use your certificate as evidence for compliance.

How long is the Anti-Money Laundering certification valid?

Our Anti-Money Laundering course certificate doesn’t include an expiry date. Although your certificate won’t expire, we recommend refreshing your knowledge every 2 years. The suggested date of renewal/refresher training is on your certificate.

Course reviews

If you’ve read the anti-money laundering course details and still are unsure if the training suits you or your workplace, we’d suggest you read our Anti-Money Laundering Course Reviews..

We pride ourselves on providing a 5-star service to all our customers. Let us know how we are doing by leaving a review on Reviews.io or leaving a review on Google, we would really appreciate it.

What is Money Laundering?

Money laundering is the crime of processing dirty money (obtained through crime) through a legitimate business, or moving it into foreign bank accounts, to hide the fact that the money was illegally obtained. The ‘cleaned’ money can then be spent as if it was obtained from legal sources.

Money laundering is usually used to fund criminal/illegal operations. Money laundering can be linked to many activities such as fraud, drug trafficking, tax violations and embezzlement.

Read our article The 3 Stages of Money Laundering that explains money laundering process in more detail.

The importance of Anti-Money Laundering training

Money laundering costs the UK billions of pounds a year. Criminals, organised gangs, and terrorists use it to move funds and pay for assets.

No one wants money laundering happening in their business. There is a risk of loss of revenue and a loss of reputation.

This online Anti-Money Laundering (AML) and Counter-Terrorism Financing course makes employees aware of illegal practices and helps them to identify AML risks. It explains the relevant UK laws, and explains the controls that must be put in place to prevent money laundering and terrorist financing.

The three stages of money laundering

Money laundering can be broken down and examined in 3 stages: placement, layering and integration. You can learn all about it in a useful blog we have provided. View the anti-money laundering blog here.

At i2Comply, we regularly post informative and educational blog posts in our knowledge centre. Keep an eye out for new articles.

Book Anti-Money Laundering training today

Booking our Anti-Money Laundering course is simple and takes only a few clicks. Start by adding the course to your basket from the top right-hand side of the page before payment.

There is no set time in which you need to complete the course after purchase. You can buy the course now and start studying whenever you like. This means you can take advantage of our bulk buying option for your staff to complete later.

Other online Regulatory Compliance courses

Are you looking for other regulatory compliance courses like our online Anti-Money Laundering training? i2Comply offer a range of courses from Equality & Diversity to GDPR.

Find a list below of all of our Regulatory Compliance courses. You can view additional information on each course by clicking the titles listed below.

- Bribery Act 2010 Training Course

- Cyber Security Training Course

- Data Protection and the GDPR Course

- Data Protection and the GDPR (Advanced) Course

- Disability Awareness Training Course

- Equality and Diversity Awareness Course

- Freedom of Information and the Law Course

- Mental Health Awareness Course

- Modern Slavery Awareness Course

- Sexual Harassment Awareness Training Course

- Unconscious Bias Training Course

Our range of online training courses is much more than just Regulatory Compliance. For example, we also offer courses on fire safety, health and safety, food hygiene and health & social care.

Questions about our Anti-Money Laundering course?

Have a few questions to get out of the way before you commit to buying our course licences? We totally understand, and we’re here to help. Contact a team member who will be happy to answer any of your questions regarding the online course.

If you aren’t aware, we have already answered some of the questions we’ve been asked in our help & knowledge base. Have a look to see if this section has previously answered your question. We’ve responded to questions on things like account settings, licences, certificates and payment.

Request an online training quote

Whether you are looking to train a small team or an entire business, we’re here to help. Let us know your online training requirements and we’ll provide you with a quote.

£20.00 + £4.00 VAT

Discounts Available For Bulk Purchases

| No. of licences per course |

% saving |

|---|---|

| 1 - 9 | - |

| 10 - 19 | 10% |

| 20 - 49 | 20% |

| 50 - 99 | 25% |

| 100 - 149 | 30% |

| 150 - 999 | 35% |